This post brought to you by Cigna.

Last year I shared with you Tips for Choosing a Health Insurance Plan from Cigna and it was full of great tips on helping to make sure you pick the health insurance plan that’s best for your family. Now that open enrollment is over it’s time to start thinking about how to save the most when it comes to using your health insurance plan. With the rising cost of health care and trying to raise a family, getting the most bang for your buck is key.

Cigna shared some of their tips for Saving on Health Costs and I have to agree that they’re some good tips!

- Stay in-network to avoid extra costs

- Prices for the same treatment can vary, so be sure to shop around

- Consider urgent care centers for nonemergency treatment (This is a BIG one. We did this and it’s saved us a lot in copay’s)

- Look for discounts on gym memberships

- Pay attention to deductibles, copays and coinsurance

- Switch to generic prescription drugs, if available

- Confirm your prescription drugs are covered

- Budget for unexpected health costs

- Don’t be afraid to negotiate prices with your doctor or hospital

- Go digital! Use apps to track your health and fitness goals

- Explore other types of benefits such as life insurance and disability coverage

- Don’t forget about dental or vision coverage

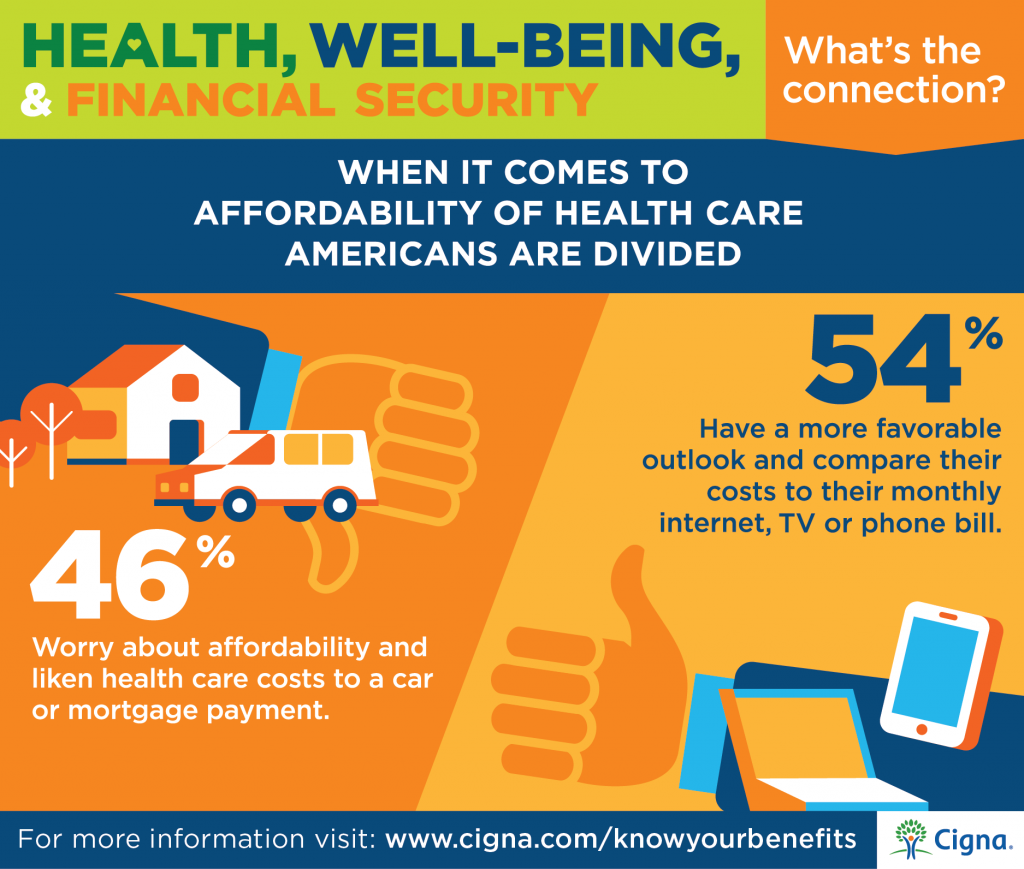

Along with sharing tips for saving on heath costs they shared their findings from a recent open enrollment survey they did. They surveyed men and women ages 25-64 and found that For most people, good health is tied to financial security. But many are worried rising health care costs will rob them of that security in the future. They also found that:

- 75% of people fear health costs could jeopardize retirement

- 44% worry health costs will limit ability to pay for child’s college

- More than half of consumers spend 1 hour or less picking a health plan

-

83% are taking steps to improve their health and they’re motivated by cash rewards, health insurance premium discounts, and positive reinforcement as ways to help them achieve their goals.

Surveys like this are helpful to companies like Cigna because they help the company understand consumers’ needs and wants and help them to build a better relationship with their customer. For more information about the survey and to get more tips to manage health costs, visit Cigna.com/knowyourbenefits.

Cigna is hosting a Twitter chat with Wisebread this Thursday from 3-4 pm EST on health and financial security. Hope you can participate! You can use #WBChat and #knowyourbenefits to follow along.

Nicole Dz

Friday 21st of November 2014

I always most likely opt for generic prescriptions as they are so much cheaper, and I check to see if my prescription drugs are covered. And using apps to track your health and fitness is a great idea.